1. Why an Offline Finance Tracker Matters in 2025

If you’ve ever lost signal, worried about data leaks, or paid for an app that locked premium features behind a subscription, you know the pain of relying on cloud‑only budgeting tools. CashFlo flips that model by storing everything locally with SQLite, so you:

-

Stay productive on long flights or remote trips

-

Keep sensitive transactions truly private

-

Avoid monthly fees (CashFlo is 100 % free and unlimited)

-

Finish critical tasks faster—no lag, no loading spinners

For treasurers of clubs, churches, or neighborhood associations—who often work in basements, halls, or rural venues—offline reliability is a game‑changer.

2. What Makes CashFlo Different?

| Feature | CashFlo (Free) | Typical Cloud‑Based Apps |

|---|---|---|

| Multi Cash Books | ✅ Unlimited | 🚫 Often paid tier |

| Works 100 % Offline | ✅ Yes | 🚫 No |

| Receipt & QR Scanner | ✅ Built‑in | ✅ / 🚫 varies |

| Debt & Receivable Ledger | ✅ With payment history | 🚫 Siloed modules |

| No Sign‑Up Required | ✅ Instant start | 🚫 Mandatory account |

| Export PDF & Excel | ✅ Free | 🚫 Paywall |

Takeaway: CashFlo delivers premium‑level bookkeeping features without charging a cent or forcing you online.

3. Deep Dive Into CashFlo’s Core Modules

3.1 Multi‑Cash Book Management

Need separate ledgers for personal spending, club dues, and a travel kitty? Create as many cash books as you like—each with its own currency, opening balance, and color label. Switch with one tap.

3.2 Smart Expense & Income Entry

-

Auto‑complete categories to reduce typing

-

Bulk import from CSV for legacy data

-

Tag transactions (home, business, trip 2025) for granular filtering

-

Attach photos or PDF receipts right inside the entry

3.3 Interactive Reports & Charts

CashFlo generates bar, line, and pie charts that visualize cash in vs. cash out, category breakdowns, and debt aging. Tap any segment to drill down to underlying transactions.

3.4 Debt & Receivable Tracker

Record who owes whom, add partial or scheduled payments, and let CashFlo calculate outstanding balances automatically. Perfect for informal IOUs or micro‑lending groups.

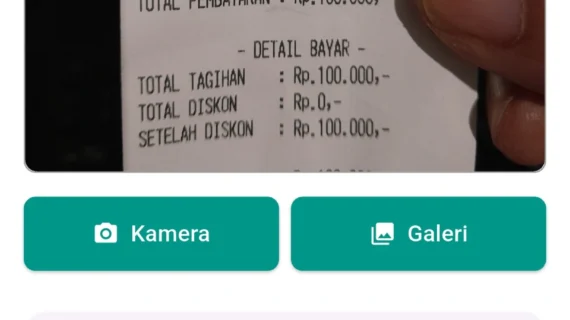

3.5 Receipt & QR Code Scanner

Powered by on‑device ML, the scanner extracts totals and dates from paper receipts, then pre‑fills an expense form. Scan vendor QR codes to auto‑populate payee fields.

3.6 One‑Tap Export

Generate PDF or Excel statements for an audit, tax return, or committee meeting—no watermark, no export quota.

4. Who Uses CashFlo?

-

Community Treasurers – Keep club fees transparent and share a monthly PDF with members.

-

Freelancers & Side‑Hustlers – Separate business expenses from personal life in distinct cash books.

-

Families on a Budget – Track allowances, grocery runs, and vacation funds offline.

-

NGO Field Officers – Record cash disbursements in remote areas without risking data over cellular.

5. Getting Started: A Three‑Minute Setup

-

Download on Google Play (search “CashFlo Budget & Expense”).

-

Open the app—no registration screens, just a blank default cash book.

-

Tap Add Transaction, categorize, and save. Done.

-

Explore Settings to add additional cash books, change currency symbol, or enable dark mode.

Pro tip: Use the in‑app tutorial (Menu → Help) for GIF‑based walk‑throughs.

6. Long‑Tail Questions Answered (FAQ)

Is CashFlo really free and unlimited?

Yes. All features—including exports and scanning—are free now and will remain free, funded by our parent company’s enterprise products.

Can I back up my data?

Absolutely. Use Export → Backup to create an encrypted ZIP you can store on Google Drive or an SD card.

Does CashFlo support multiple currencies?

Each cash book can use a separate ISO currency, ideal for travelers or international treasurers.

When will the iOS version launch?

Development is underway; sign up for the newsletter in‑app to get early TestFlight access in Q4 2025.

How secure is my data if it’s offline?

Data never leaves your device unless you export it. You can add a PIN or biometric lock for extra protection.

7. Advanced Tips for Power Users

-

Batch Scan Receipts – Long‑press the Plus (+) icon to open multi‑capture mode.

-

Custom Excel Templates – Drop a template into

/CashFlo/Templates/to map exports to your bookkeeping format. -

Automated Monthly Summary – Enable push notifications to receive a PDF report on the first of every month.

8. Roadmap 2025 → 2026

| Quarter | Planned Feature |

|---|---|

| Q3 2025 | iOS release (SwiftUI) |

| Q4 2025 | Cloud‑optional sync & shared cash books |

| Q1 2026 | AI‑powered category suggestions (on‑device) |

| Q2 2026 | Open‑source plugin SDK for custom reports |

9. Final Thoughts: Why You Should Download CashFlo Today

In a landscape packed with freemium finance tools that harvest data or hide essentials behind paywalls, CashFlo stands out as the best free offline personal finance app. Whether you’re balancing a family budget, managing club funds, or just want a simple way to record pocket‑money transactions, CashFlo delivers professional‑grade bookkeeping without the professional‑grade price tag.

Ready to take control of your cash flow?

👉 Download CashFlo on Google Play

And remember to leave a review—your feedback fuels the next round of features!